Intel sells its Arm shares and raises almost $150 million. This is peanuts in the tech world.

Intel hasn't been doing well lately. Intel is not doing well in the PC gaming market, which, afterall, only makes up a small portion of Intel's revenue. Intel hasn't been doing well, even when you look at the raw numbers. The company's stock has dropped almost 60% this year. It's not surprising that Intel is also selling a lot of shares.

Intel has sold its entire 1.18 million shareholding in Arm Holdings. (Via Reuters). According to Reuters, this sale should have raised nearly $150 million for the company (146.7 million).

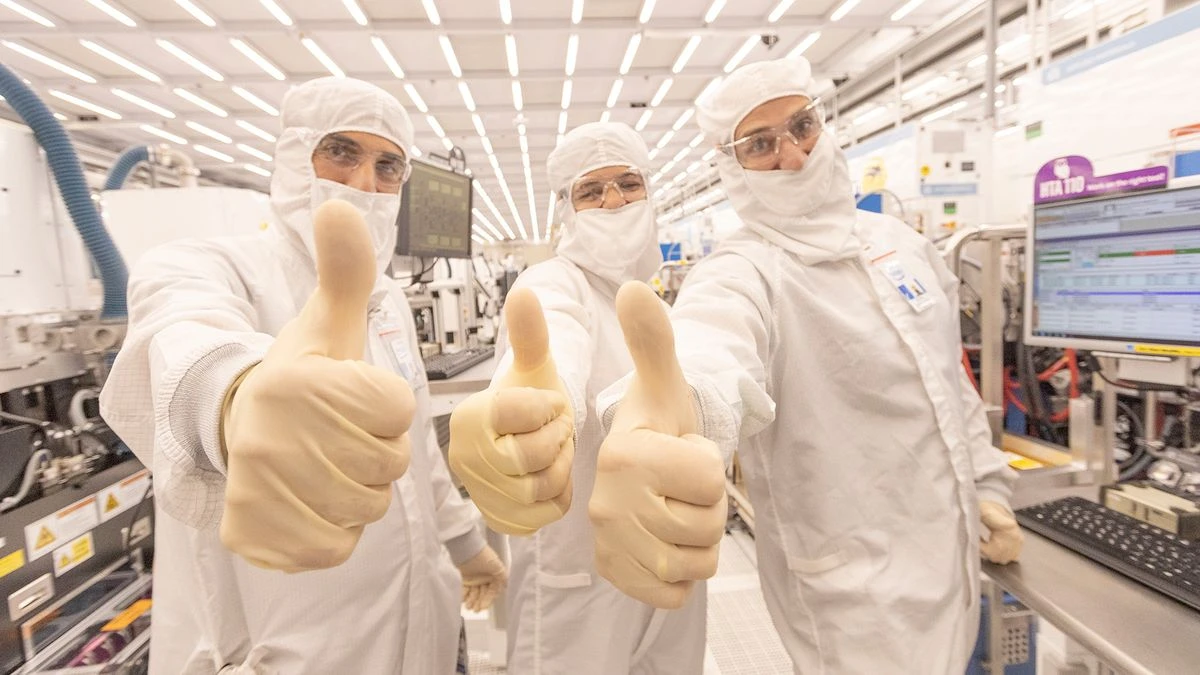

Chipzilla has been working on a new strategy since a long time, which is to move to a fabrication model for hire similar to TSMC. Intel recently partnered up with Arm to ensure that its future chips would work with Intel's production node 18A, saying it was happy to make the Arm chips which could threaten its x86 hegemony.

This news is likely to have caught the attention of many people, because Intel has sold its shares in the company with which it just formed a partnership. But these shares haven't just vanished into thin air. They've simply changed hands. Arm is doing well.

In fact, $150,000,000 is a small amount in the chip manufacturing industry. Intel, for example, committed to spending more than $185 billion on fabs, packaging and test sites. It's looking like $30 billion will go to the production of a brand new fab in Arizona.

If the recent share sales were indeed worth almost $150 million then that would be just 0.5% of the cost of the Arizona factory and 0.08% Intel's planned expenditure. It's nothing to get excited about.

One way to look at it is that it's not a big deal. It's also a bad sign if a company is forced to generate so much liquidity, especially if it is done by selling shares of a partner company.

What would we then expect, given Intel’s strategy? We won't know what the ultimate results of this strategy will be for a long time.

It will be strange to see Intel making chips for other companies, while other companies are making chips for Intel. TSMC, it is rumoured, will be producing the majority of Intel's Arrow Lake chips for next-generation as it did for Meteor Lake. The strategy should pay off, unlike Intel which recently halted its dividend. Intel will be on a firmer footing with a new business plan.

Comments