Samsung has been considering selling its manufacturing division as 3 nm yields are low and the stock price of the chip giant is falling.

Moore's Law states that transistor counts double about every two years. If there is a massive yield loss for each successful chip, transistor counts are not important. The amount of money and capital needed to keep up with ever-increasing transistor counts will be prohibitive. Samsung seems to be in this position right now with their 3 nm node.

Business Korea (via TechPowerUp), notes that a report published in July by Samsung Securities suggested the division Samsung Foundry, which produces chips for other companies, be spun off. Business Korea reports that the report paints a bleak picture. It predicts a "loss of 500 billion won (approximately 385 million dollars)" for Samsung's non-memory division.

Samsung's response is to consider different strategies, including possibly spinning off its foundry business. Business Korea reports that the chip giant claims "since the foundry industry requires closer contact with customers, active localization such as establishing additional US plants is necessary." It also asks "How about spinning out the foundry division and listing it in US?"

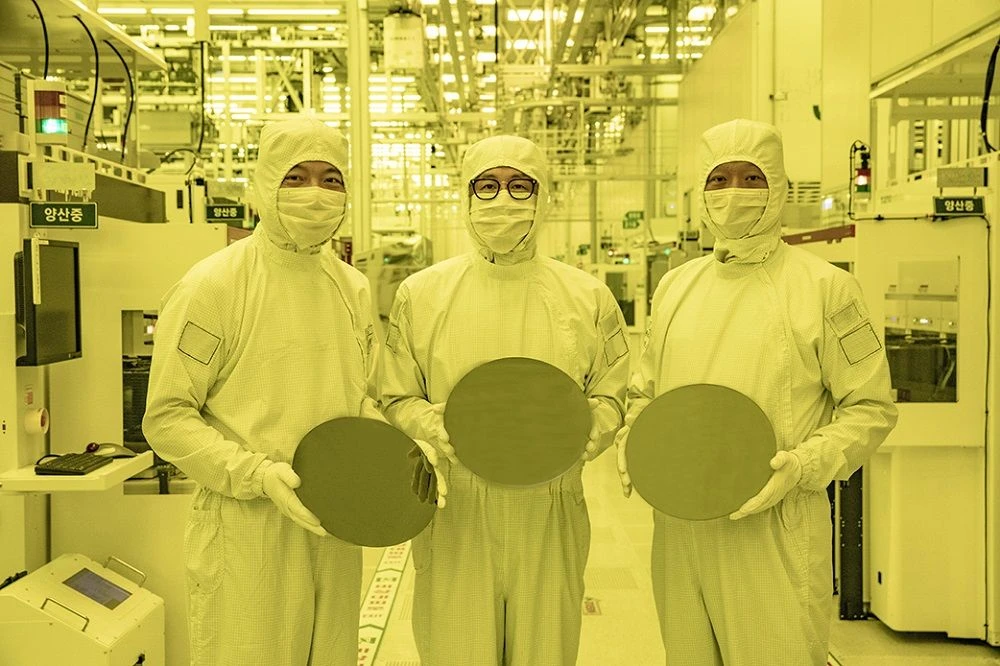

The company's 3nm 3GAA 3GAA process has been struggling to produce chips since it began in 2022. We heard about low-yields earlier this year and to a lesser degree, even back in 2023.

The yield is the number of fully functional chips that can be produced per batch. The lower the yield the fewer chips are produced. If yields are low as they appear to be for Samsung's 3nm node then companies will be less inclined to want to make their chips using it, as they are likely to receive less return on their investment.

We can't be too reductionist to blame the low 3 nm production yields for all of the talk about a foundry spinoff. It will be a factor. TSMC's nodes with a 3 nm process seem to be doing better. Nvidia is sticking with N4 for Blackwell. TSMC, however, has reported that its N3 nodes have reached full capacity due to their inclusion in Intel Lunar Lake laptops as well as Apple's iPhone 16

TSMC is still the leader in mass-produced chips, namely AI and data centers. Combining this with the disappointing 3 nm Samsung process and geopolitical issues, it may make sense for Samsung's foundry to go its own way.

News of any process node struggles is not good for us, the end users. TSMC is producing chips well, but healthy competition almost always leads to lower prices for components and chips. Let's hope Samsung can get things back on track.

Comments